Highlights

Automated cryptocurrency trading system

API key connection to exchanges, with no withdrawal rights

Helps you find arbitrage opportunities faster

Fast detection of arbitrage opportunities

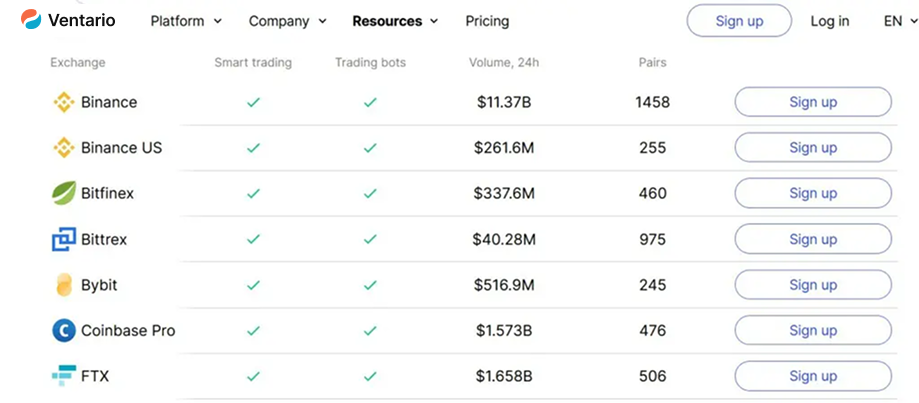

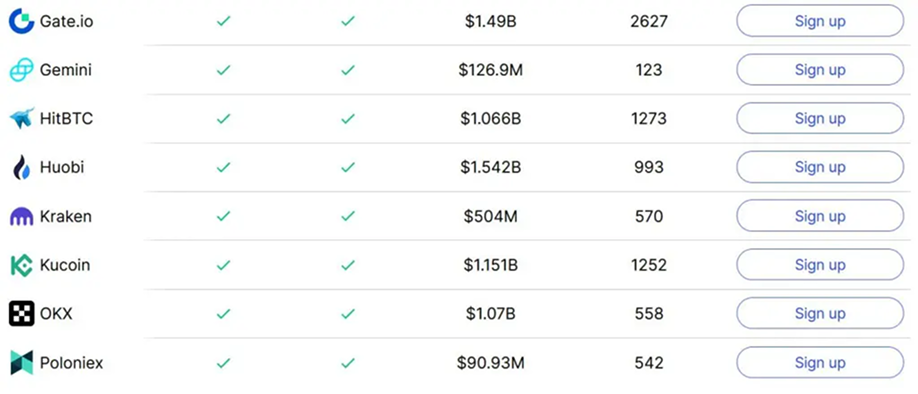

Supports 26 major exchanges

Runs smoothly and without interruptions

Pros&Cons

Pros

- Flexible pricing plans

- 7-day free trial available

- Quick and simple registration

- Wide range of useful tools

- Ready-made trading strategies

- Mobile app for Android, iPhone, and iPad

Cons

- Trading signals feature is currently unavailable

Key takeways

Ventario provides automated trading bots, arbitrage tools, and a unified dashboard to manage all assets. The platform is beginner-friendly, thanks to its all-in-one interface. Since its launch, the service has gained traction among traders and continues to grow steadily. Security is ensured through API connections — only you have access to your funds.

What is Ventario?

Ventario is an automated trading platform designed to simplify the trading process. Its core goal is to reduce routine tasks and provide traders with proven algorithms. Even on the basic subscription plan, users can launch several bots and try out different strategies.

Ventario Key Features

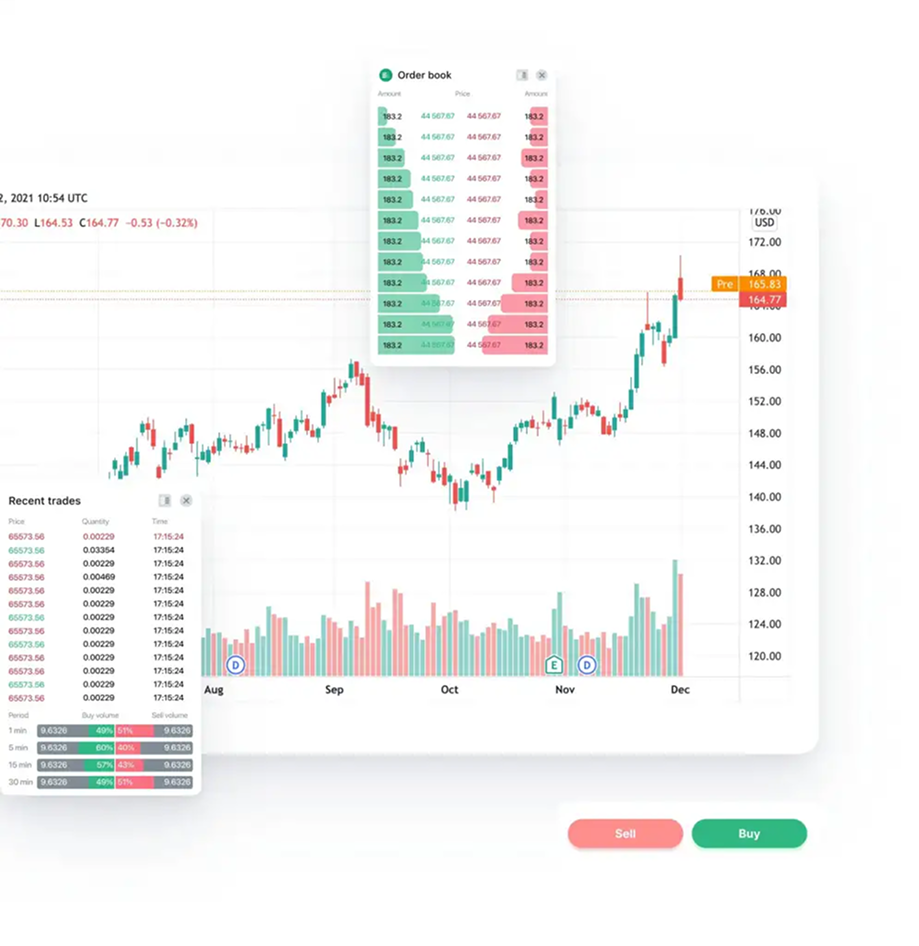

- Trading terminal — trade spot and futures from a single interface

- Arbitrage trading — identify and act on price differences between exchanges

- Futures bots — automate futures trading with customizable settings

- Strategies — a library of pre-tested strategies across hundreds of pairs

- Portfolio management — monitor assets and returns in real time

- Automated bots 24/7 — execute trades continuously without manual input

- Demo account — test strategies and practice trading without risk

- Grid bot — capitalize on small price movements for consistent gains

Ventario History

Ventario was launched in 2017, during a time when automated crypto trading was still in its infancy. Most traders back then relied on manual execution or basic bots with limited functionality. Ventario entered the market with the idea of creating an all-in-one solution: a platform that could handle portfolio tracking, arbitrage, and trading bots under one roof.

Over the years, Ventario has steadily expanded its user base. Early adopters were mainly individual traders experimenting with automation, but the platform quickly grew to attract professionals who needed scalable tools. By 2020, Ventario had already become a recognizable name in the automated trading sector, with a significant portion of its traffic coming from Europe and Latin America.

Today, the platform has thousands of registered users and has processed billions in trading volume. Its success can be attributed to continuous updates, a focus on security, and an effort to make trading bots accessible to both beginners and advanced traders.

How Does Ventario Work?

At its core, Ventario connects directly to crypto exchanges via API keys. This method ensures that user funds remain on the exchange while the platform sends trading instructions. The system is cloud-based, which means traders don’t need to keep their devices online 24/7 for bots to function — everything runs on Ventario servers.

Once connected, users can choose from different tools: spot and futures trading terminals, arbitrage scanners, or automated bots. A beginner might start with a simple grid bot on a major pair like BTC/USDT, while an experienced trader could design a multi-bot strategy across several exchanges.

Flexibility is key here. You can monitor performance in real time, adjust settings mid-trade, or stop bots at any point. The dashboard consolidates multiple accounts into one place, so you don’t need to jump between platforms to manage your portfolio.

How Can Ventario Signals Be Useful?

In its earlier versions, Ventario offered a dedicated trading signals feature. It worked by analyzing market movements and detecting unusual patterns, such as sudden spikes in volume or rapid price shifts. Traders would then receive alerts, allowing them to react quickly before the opportunity passed.

Although the standalone signal function has since been phased out, its core ideas remain embedded in the platform’s strategy tools. Backtesting and predefined strategies now take on the role of providing actionable insights. For instance, instead of simply receiving a signal to buy or sell, users can deploy a bot preprogrammed to act when similar conditions appear.

This evolution reflects a broader trend in crypto: traders want more than alerts. They want automation that executes for them, reducing emotional decisions and missed chances. In that sense, Ventario signals have transformed into something more practical — directly usable trading strategies.

Predefined Strategies With Backtesting

One of the most attractive features for new users is the ability to choose from a library of predefined strategies. These are not random templates but setups tested against historical market data. Each strategy comes with a backtesting report that shows how it would have performed in different market conditions — bullish, bearish, and sideways.

Backtesting allows traders to understand the potential strengths and weaknesses of a setup before risking real capital. For example, a DCA (Dollar-Cost Averaging) bot might show steady results in volatile conditions, while a grid bot could perform better during periods of consolidation.

Users can either adopt these strategies as they are or modify them based on personal risk tolerance. This balance between guidance and customization is what makes Ventario especially useful for those who are still learning but want professional-level tools at their disposal.

How Does Ventario Find Opportunities for Arbitrage?

Arbitrage trading relies on exploiting price differences between exchanges. In practice, this can be difficult to track manually, as price gaps often close within seconds. Ventario automates the process by scanning its network of supported exchanges and flagging profitable opportunities in real time.

The platform supports both crypto-to-crypto and crypto-to-fiat arbitrage. For example, you might see a scenario where Bitcoin is slightly cheaper on Exchange A and slightly more expensive on Exchange B. With Ventario, a single click executes the trade, capturing the spread before it disappears.

What sets Ventario apart is its speed and integration. Since it monitors dozens of exchanges simultaneously, the likelihood of spotting profitable spreads is much higher. For active traders, this can add up to consistent incremental gains — especially when combined with other strategies.

Is Ventario Safe?

Security is one of the most important considerations for any trading platform, and Ventario takes this seriously. Unlike shady services that require you to deposit funds directly, Ventario never holds your money. Instead, it connects to your exchange account through API keys that only grant trading rights. Withdrawals remain disabled by default, so even if someone accessed your Ventario account, they wouldn’t be able to move your funds.

In addition, users can enable two-factor authentication (2FA) for account access, and all sensitive data is encrypted. The platform’s reputation has also grown over the years thanks to transparent operations and consistent uptime.

Of course, no system is risk-free — crypto markets themselves are volatile, and poor strategy choices can still lead to losses. But in terms of technical and operational safety, Ventario stands among the more reliable trading solutions on the market today.

Ventario Suppored Exchanges

The system supports 26 major exchanges, which expands arbitrage opportunities and portfolio management options.

Ventario Pricing

Basic Plan — Free

- Micro-investments up to €100/month

- Access to the basic crypto bot

- Full demo of all platform features

- Introductory training on strategies and platform use

- Standard email support

- Perfect for getting started

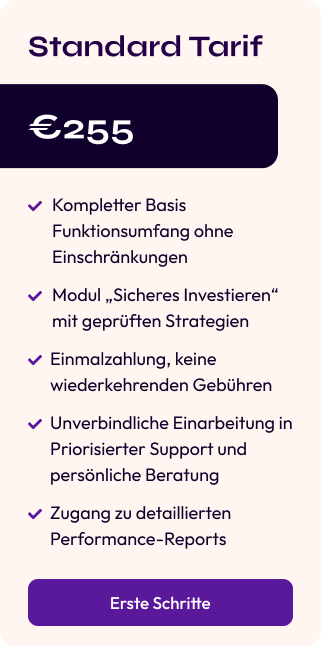

Standard Plan — €255 (one-time)

- Full functionality without restrictions

- “Safe Investing” module with tested strategies

- One-time payment, no recurring fees

- Priority support with personal guidance

- Access to detailed performance reports

- Best choice for active individual traders

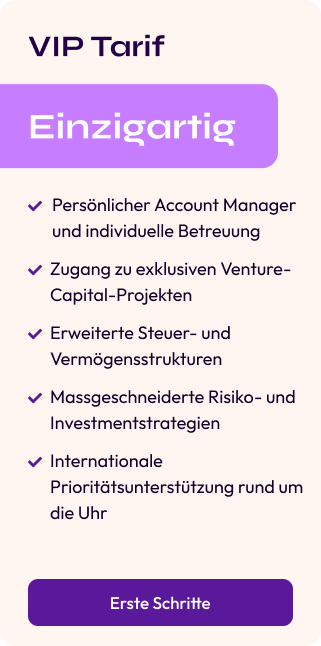

VIP Plan — Exclusive

- Dedicated account manager and tailored assistance

- Access to exclusive venture capital projects

- Advanced tax and wealth structuring options

- Customized risk and investment strategies

- 24/7 international priority support

- Designed for professional and institutional clients

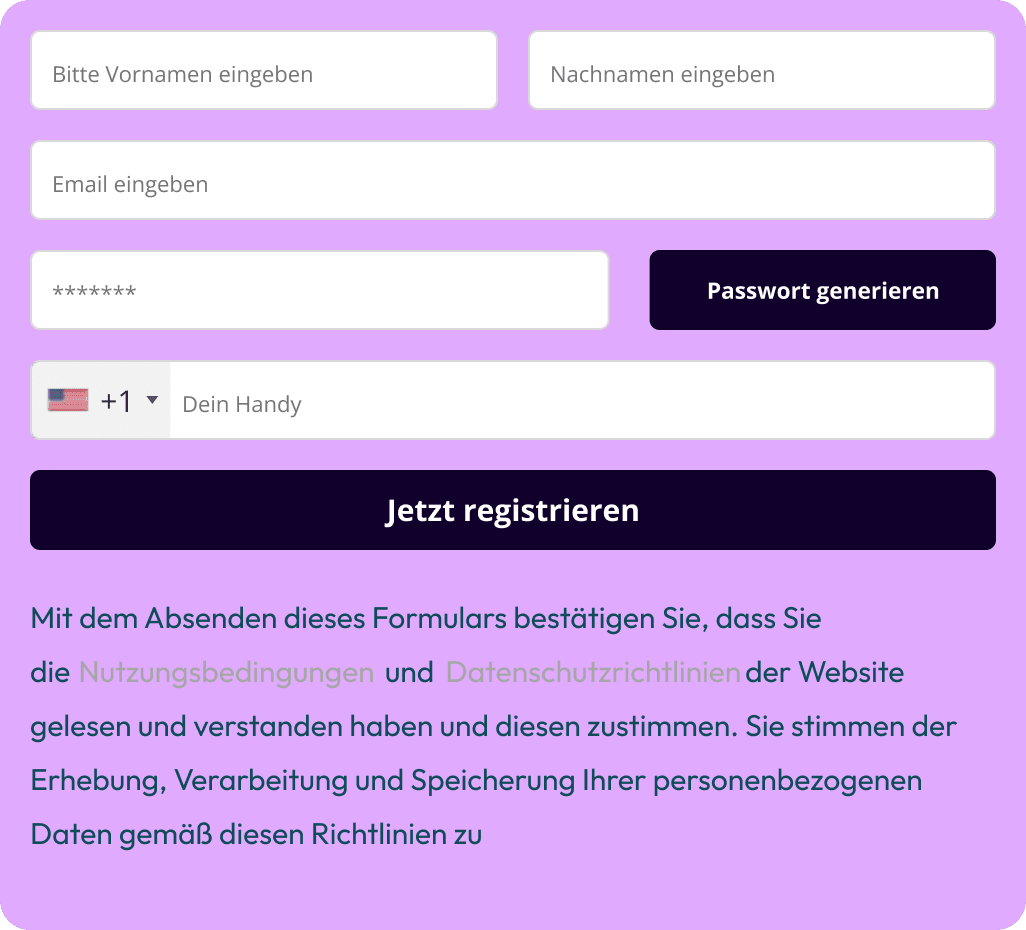

How Can I Start Using Ventario?

- Enter your phone number and full name to create your profile.

- Wait for a call from a Ventario manager who will guide you through the setup process.

- Make your initial deposit to activate trading features.

- Choose a strategy that fits your goals and start trading right away.

FAQ

Is Ventario Trusted?

Yes. The platform is actively maintained and updated.

Where Is Ventario Located?

It operates as an online platform with a distributed team.

Does Ventario Have an App?

Yes, available for both Android and iOS.

How Much Should I Invest in Ventario?

It depends on your strategy. The system suggests the minimum required balance when you set up a bot.

What Is Sum Total P&L in Ventario?

It represents the overall profit or loss across all bots compared to your starting balance.

Does Ventario Have a Customer Support Option?

Yes, via live chat and email. Response times are typically fast.