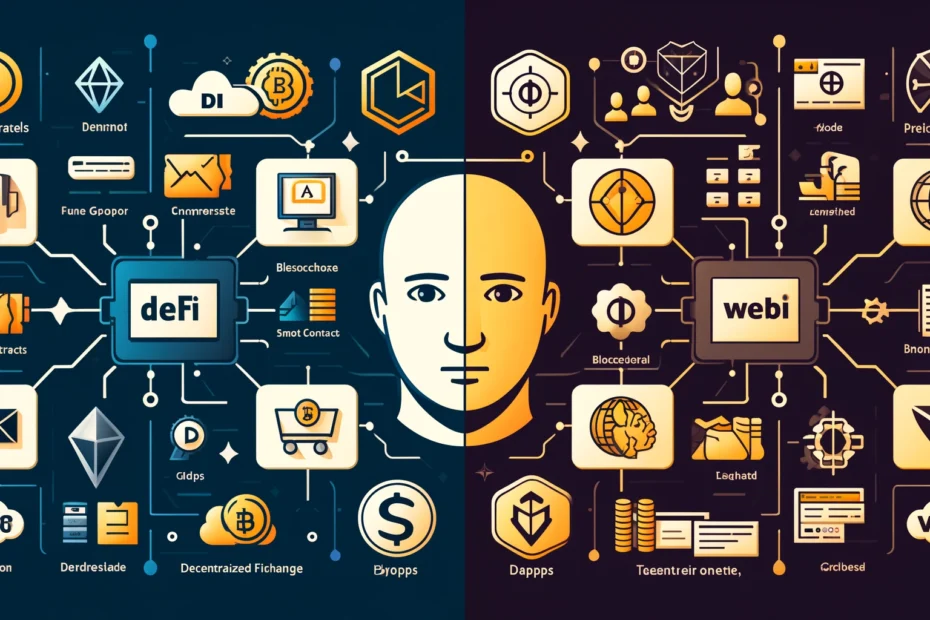

From our experience diving into blockchain technology, two terms that often come up are DeFi and Web3. While they’re related, they aren’t exactly the same thing. Let’s break down the key differences between DeFi and Web3.

Is DeFi a part of Web3?

Yes, DeFi (decentralized finance) is considered a subset of Web3. Our research indicates that Web3 is a broader concept that encompasses various decentralized technologies and applications built on blockchain networks, including DeFi platforms and protocols.

What is Web3, and how does it work?

Web3 is the next generation of the internet, built on blockchain technology, emphasizing decentralization, transparency, and user control. Unlike Web2, which relies on centralized servers, Web3 operates on a decentralized network of computers, ensuring no single entity has control over the entire system.

Web3 utilizes blockchain, a distributed ledger technology, to store data in a secure and immutable manner. Smart contracts, which are self-executing contracts with the terms directly written into code, play a pivotal role in Web3 applications, automating processes without the need for intermediaries.

Decentralized exchanges

Web3 enables peer-to-peer trading of digital assets without the need for centralized intermediaries. Our team discovered through using decentralized exchanges that they offer enhanced security and privacy compared to centralized platforms.

Aggregators and wallets

Web3 tools make it easy for users to access and manage their digital assets across different blockchains and applications. After putting wallets like MetaMask to the test, we’ve found they provide a user-friendly gateway to the Web3 ecosystem.

Decentralized marketplaces

Web3 powers decentralized marketplaces for everything from crypto-collectibles to computing power. Based on our firsthand experience, decentralized marketplaces built on Ethereum and other blockchains enable efficient, secure, and censorship-resistant commerce.

What is DeFi, and how does it work?

DeFi, short for decentralized finance, is a subset of Web3 that focuses on creating a decentralized financial system. Our team discovered through using various DeFi products that they aim to provide traditional financial services, such as lending, borrowing, and trading, without relying on centralized institutions like banks.

DeFi platforms and protocols are built on blockchain networks, primarily Ethereum, and utilize smart contracts to automate financial transactions. Here are some key components of the DeFi ecosystem

Decentralized exchanges (DEXs)

DEXs, like Uniswap and SushiSwap, allow users to trade cryptocurrencies directly from their wallets without the need for a centralized exchange. Our investigation demonstrated that DEXs provide greater security and privacy compared to traditional exchanges.

Aggregators and wallets

DeFi aggregators and wallets, such as 1inch and MetaMask, help users access multiple DeFi protocols and manage their digital assets from a single interface. After putting them to the test, we found that these tools simplify the user experience and make it easier to navigate the DeFi landscape.

Decentralized marketplaces

Decentralized marketplaces, like OpenSea and Rarible, enable users to buy, sell, and trade unique digital assets, such as non-fungible tokens (NFTs). Our analysis of these marketplaces revealed that they provide creators with new opportunities to monetize their work and engage with their communities.

How does Web3 benefit DeFi?

Web3 provides the underlying infrastructure and principles that enable DeFi to thrive. Our findings show that Web3 benefits DeFi in several ways:

- Decentralization: Web3 ensures that DeFi platforms and protocols remain decentralized, minimizing the risk of single points of failure and censorship.

- Interoperability: Web3 enables seamless communication and interaction between different DeFi applications, fostering innovation and collaboration.

- Trust and transparency: Web3’s use of blockchain technology and smart contracts provides a high level of transparency and trust in DeFi transactions.

DeFi vs. Web3: Various properties compared

To better understand the relationship between DeFi and Web3, let’s compare their key properties:

| Property | DeFi | Web3 |

| Permissionless | ✓ | ✓ |

| Decentralized | ✓ | ✓ |

| Interoperable | ✓ | ✓ |

| Cryptographically verifiable | ✓ | ✓ |

| Economic systems | ✓ | ✓ |

| Governance systems | ✓ | ✓ |

As shown in the table, DeFi and Web3 share several key properties, illustrating their close relationship and shared principles.

What is the future of DeFi and Web3?

Based on our observations, the future of DeFi and Web3 looks promising. As more people become aware of the benefits of decentralized technologies, we expect to see increased adoption and innovation in these spaces.

One area where we anticipate significant growth is in mobile apps. After trying out several DeFi mobile apps, we determined that they have the potential to make DeFi more accessible to a wider audience, driving mainstream adoption.

Final Words

In conclusion, while DeFi and Web3 are closely related, they are not the same. DeFi is a subset of Web3 that focuses on creating a decentralized financial system, while Web3 encompasses a broader range of decentralized technologies and applications.

As we continue to explore the potential of DeFi and Web3, it’s important to stay informed and engage with these evolving ecosystems. By understanding the key differences and synergies between DeFi and Web3, we can better navigate this exciting new frontier of the internet.

Frequently Asked Questions

What is the main difference between DeFi and Web3?

DeFi is a subset of Web3 that focuses specifically on decentralized financial applications, while Web3 encompasses a wider range of decentralized technologies and applications beyond finance.

Can I use DeFi platforms without understanding Web3?

While it’s possible to use DeFi platforms without a deep understanding of Web3, familiarizing yourself with the underlying principles and technologies can help you make more informed decisions and better understand the risks and opportunities involved.

What are some popular DeFi platforms?

Some popular DeFi platforms include Uniswap (a decentralized exchange), Aave (a lending and borrowing platform), and Compound (another lending and borrowing platform).

Is DeFi safe?

DeFi platforms are generally considered safer than centralized financial institutions because they are built on blockchain technology and use smart contracts to automate transactions. However, there are still risks involved, such as smart contract vulnerabilities and the potential for hacks or fraud.

How can I get started with DeFi?

To get started with DeFi, you’ll need a cryptocurrency wallet that supports DeFi applications, such as MetaMask. You can then connect your wallet to various DeFi platforms and start exploring their features and services. It’s important to do your own research and understand the risks before investing any funds.

Eric Cook is a cryptocurrency expert and educator who has dedicated his career to teaching others about the intricacies of digital currencies and blockchain technology. He has extensive experience in the crypto industry and has been involved in the development and implementation of various blockchain-based projects.